Discover how to calculate if a property is a good investment. Learn how to know if a property offers the right value for money in our guide to real estate ROI.

Real estate is a popular investment choice for many people, especially those with extra capital who want a guaranteed investment return. However, it can be challenging for those just getting started to keep track of all the facts and figures when evaluating potential properties.

So, how do you know if you’re making the right real estate investment choice?

Fortunately, there’s a metric that can help you determine quickly and easily if an investment property is worth considering. That metric is known as Return on Investment (ROI), and computing it is how to calculate if a property is a good investment.

At Yield Investing, we pride ourselves on offering some of the most ethical investment opportunities in the UK, such as high-yielding buy-to-let housing developments with social housing contracts. However, before you invest, let’s help you understand how ROI works in the first place and how to calculate if a specific property is a good investment using this metric.

Introduction to Real Estate ROI

If you’re considering investing in real estate, you may come across the term Return on Investment or ROI. This metric measures the potential profitability of property investment.

To calculate a property’s ROI, you need to know the following:

- The initial costs of purchasing and owning the property, such as:

- Taxes

- Legal fees

- Maintenance fees

- Other expenses related to owning a rental property

- Potential returns on the property, which can come from the following:

- Rent charges

- Income from ancillary services like laundry or parking fees

- Capital appreciation over time.

Once you are clear on all these figures, you can calculate the ROI on a property to see if it’s a good investment.

How to Calculate Real Estate Investing ROI

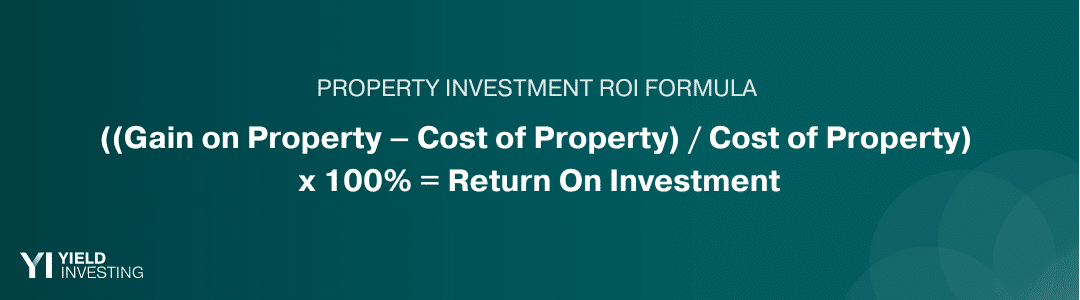

To calculate the ROI, the formula is as follows:

ROI = [(Gain on Property – Cost of Property) / Cost of Property] x 100%

Here’s an example to explain how to break down the formula into “real figures”.

If you purchase a rental property for £100,000 and sell it for £140,000 after five years, and you have a cash flow of £7,000 per year, then the gain on the investment is £175,000 (£40,000 from the selling price increase, £35,000 from the cash flow, and £100,000 from the initial investment).

The ROI on a Cash Purchase = [(£175,000 – £100,000) / £100,000] x 100% = 75%.

The cash-on-cash return of the rental property can also be calculated using the following formula:

Cash-on-Cash ROI = [Annual Before-Tax Cash Flow / Total Cash Invested] x 100%

Using the above example, the cash-on-cash ROI = £7,000 / £100,000 x 100% = 7%.

What is a Good ROI in Real Estate?

A “good” ROI in real estate is subjective and can vary depending on several factors, such as:

- Location

- Market conditions

- Investment strategy

- Personal goals

However, the average annual ROI for residential real estate is presently around 10%, so anything above that is better than average.

How to Calculate Long-Term ROI on Properties in the UK: 3 Vital Metrics

When calculating whether a property is a good investment, looking at long-term ROI is vital. In the UK, you can calculate long-term ROI on properties in several ways using any of the following metrics.

House Price Index (HPI)

HPI is a tool that helps investors determine potential returns by identifying areas where house prices have increased or decreased. This can help investors decide which properties will likely bring substantial returns. For example, the UK government website provides HPI data that investors can use to evaluate the long-term ROI of a property.

Property Value Estimators

Using property value estimators is another way to understand potential future ROI on property investment. These are widely available online and often provided by estate agents, property portals and banks. Property value estimators can provide calculations based on current market conditions, such as:

- Sales prices of similar properties in the same area

- Any estimated increase or decrease in the value of the property in question over time

Rental Yields

Rental yield calculators take into account factors such as:

- Market rent for similar properties

- Length of the tenancy agreement

- Any maintenance or upkeep costs

This metric should give you an idea of how much money you could make from monthly rental income, making it an essential tool if you’re looking for long-term ROI from your investments.

Understanding the long-term ROI for investments is essential when determining whether a property will be a good investment in the long run. These tools will help you calculate that accurately, helping you make well-informed decisions about your real estate investments.

How to Calculate ROI on a Rental Property in 4 Steps

Calculating the return on investment (ROI) for rental properties in the UK for cash transactions involves comparing the net yearly income generated by the property to the total money (in cash) invested in the property.

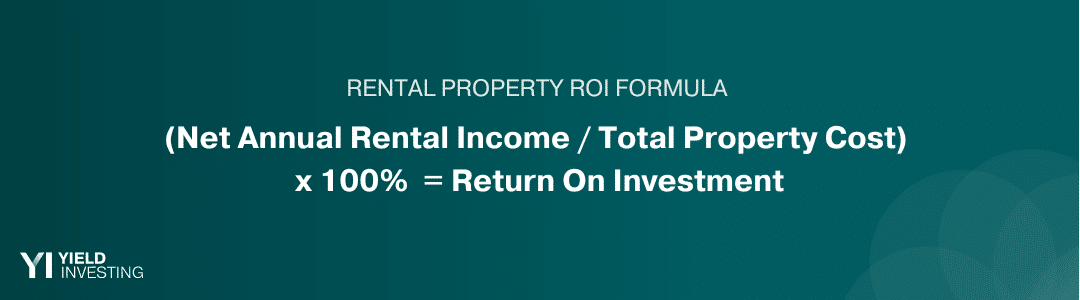

This metric can be calculated using the following formula:

ROI = [Net Annual Rental Income / Total Property Cost] x 100%

Where:

Net Annual Rental Income = Gross Annual Rental Income – Annual Property Expenses

Total Property Cost = Purchase Price + Acquisition Costs + Renovation Costs

Let’s break down each formula and provide examples to illustrate how to calculate rental property ROI for cash transactions.

Step #1: Calculate the Gross Annual Rental Income (GARI)

Simply termed the gross rental income (GRI), this is the total rent you receive from your tenants in a year.

For example, if you own a rental property that generates £1,000 per month, the gross rental income for the year would be £12,000.

Step #2: Calculate the Annual Property Expenses

These are the costs associated with owning and managing the rental property, including:

- Property taxes

- Insurance

- Repairs

- Maintenance

- Property management fees

- Other expenses

For example, if your property has an annual property tax of £1,000, an insurance premium of £500, and a property management fee of £1,200, the total expenses would be £2,700.

Step #3: Calculate the Net Annual Rental Income (NARI)

This is the gross annual rental income (GARI) minus the annual expenses of owning and managing the rental property. It’s also known as net rental income (NRI) or net operating income (NOI).

Using the examples above, we can calculate the net annual rental income as follows:

Net Annual Rental Income = Gross Rental Income – Annual Property Expenses

Net Annual Rental Income = £12,000 – £2,700

Net Annual Rental Income = £9,300

Total Property Cost = This is the total amount of money invested in the rental property, including:

- The purchase price

- Acquisition costs, such as:

- Legal fees

- Stamp duty

- Renovation costs (if any)

For example, if you purchased a rental property for £200,000, paid £5,000 in acquisition costs and £10,000 in renovation costs, the total property cost would be £215,000.

Step #4: Calculate the ROI

This is the percentage return on investment you can expect from your rental property.

Using the examples above, the ROI can be calculated as follows:

ROI = [Net Annual Rental Income / Total Property Cost] x 100%

ROI = [£9,300 / £215,000] x 100%

ROI = 4.33%

In this example, the ROI for the rental property is 4.33%. This means that for every £1 invested in the property, you can expect a return of £0.0433 per year.

Note:

- The ROI calculation doesn’t consider potential changes in property values over time, which can significantly impact the overall return on investment.

- You should also consider the risks associated with owning and managing rental properties, such as:

- Changes in rental demand

- Unexpected repairs and maintenance costs

- Tenant turnover

However, if you invest in our risk-free assets, you don’t need to account for damages and maintenance and are sure of a constant tenant turnover. This will increase your ROI and result in more yearly gains. You can check out some of our development projects here.

Other Considerations When Calculating Property ROI

When deciding whether to invest in a property, there are other factors to consider beyond the initial ROI calculation.

These include:

Location

Your investment property’s location is crucial to whether you can quickly sell or rent it out. Properties in areas with high demand and low supply will likely yield higher returns than those with low demand.

Tax Considerations

You should also consider any taxes that may be due on the investments, such as capital gains tax (CGT). This can significantly impact a property’s overall return on investment, so you must ensure you understand your tax obligations before dabbling into property investment.

Holding Costs

The property holding costs, such as repairs and maintenance, must be factored in when working out ROI. These can vary depending on the type of property purchased and its age. It’s essential to account for these holding costs when calculating ROI to have a realistic idea of the total return you will receive from the investment.

3 Key Property Investment Calculation Metrics

When considering investing in property, there are several calculations you can use to determine if it’s a wise investment. These calculations include the gross rental yield, net rental yield and capital growth.

Gross Rental Yield (GRY)

This metric divides the property’s annual return on rental income by the purchase price.

Gross Rental Yield = [Annual Rental Income / Cost of Investment] x 100%

A desirable return for a real estate investor in the UK should be 8–10%.

Net Rental Yield (NRY)

This metric divides the property’s annual rent income less any fees associated with renting out the property from the annual rental income (such as maintenance costs, mortgage payments, and agent fees) by the purchase price.

Net Rental Yield = [(Annual Rental Income – Annual Property Expenses) / Cost of Investment] x 100%

This provides a more realistic assessment of your ROI on that specific financial commitment.

Capital Growth (CG)

The capital growth metric evaluates how much your invested capital has increased over time. This is determined by looking at how much a property has increased in value since you bought it initially and subtracting inflation from that number to get an accurate figure of how much financial benefit you’d be getting out of that specific asset over time.

How to Calculate If a Property Is a Good Investment

Let’s use an example to explain the above three metrics:

If you purchase a property for £250,000 and earn £25,000 annually in rental income, your Gross Rental Yield is 10%.

GRY = [£25,000 / £250,000] x 100% = 10%

However, if you deduct £5,000 in fees from the income, your Net Rental Yield becomes 8%.

NRY = [(£25,000 – £5,000) / £250,000] x 100% = [£20,000 / £250,000] = 8%

If the property appreciates by 2% over time and inflation is 1%, your Capital Growth will be 1%.

CG = 2% – 1% = 1%

These calculations can help you make informed decisions and determine whether a property investment is worthwhile.

How Rental Properties Differ From Other Real Estate Investments

Before investing in real estate, it’s essential to understand that rental properties differ from other investments. In most cases, rental properties are best suited for long-term growth and more advantageous than short-term investments.

This is because rental properties typically produce a steady income that can be used to pay down the mortgage, offset other costs associated with maintaining the property, and even allow for some additional profits.

There are a few key factors to look into when considering rental properties as an investment, including the following:

- The property’s condition and any upgrades you may need to make before it’s ready for tenants.

- Any additional costs, such as taxes and insurance, due on the property.

- Potential tenant pool: will it be easy to attract suitable tenants?

For example, a property close to public transport links or amenities will likely have more appeal than one in a remote area.

- The local market and factors such as:

- Housing market volatility

- Population growth or decline

- Job market trends

These can affect a property’s potential to accrue an attractive return on the initial investment.

By understanding the local markets and considering all costs when purchasing a rental property, investors can benefit from long-term returns that outpace those seen with stocks or bonds over time.

How Do You Determine If a Property Is a Good Investment?

One widespread formula to help you determine if a property is the right investment for you is the 1 per cent rule. This rule typically suggests that the property’s monthly rent shouldn’t be less than 1 per cent of the initial cost after factoring in any preliminary repairs and property costs. To illustrate, a property costing £100,000 should have a minimum monthly rent of £1,000.

However, it’s important to do further research and analysis to make a well-informed decision about investing in a particular property.

To determine if a house is a good investment, you should also consider the following:

- Location

- Market trends

- Potential rental income

- The property’s condition

- The investment’s overall cost

For example, if you buy an investment property that needs a lot of repairs or works carried out before you can rent it out, these costs need to be incorporated into your ROI calculations to ensure they will be covered without impacting your profits.

How to Calculate the Value of Property: 3 Factors to Consider

If you’re considering investing in rental property in the UK, it’s essential to understand the potential returns on your investment. To do this, you need to know how a property is valued.

The Royal Institution of Chartered Surveyors (RICS) provides detailed guidelines for property valuation, which involves looking at three main factors:

Comparable sales in the neighbourhood

This refers to recent sales of similar properties in the surrounding area. This information provides insight into the current market value of the evaluated property.

The condition of the property

The property’s condition considers any repairs or improvements that might be needed. Surveyors will examine the property’s overall condition, including the structure, plumbing, electrical systems, and any cosmetic updates it may require.

The rental income generated by the property

The property’s rental income is also significant, especially for investment properties. Surveyors will examine the current rental income and compare it to similar properties to determine if it’s reasonable. The rental income estimates the potential return on investment for the property.

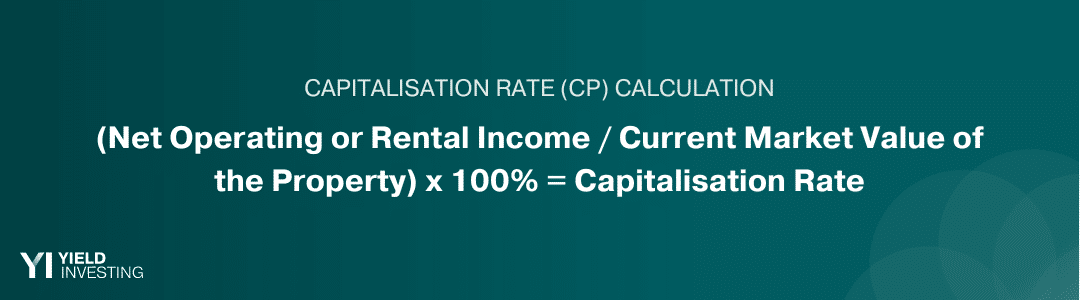

The Capitalisation Rate (CP) Calculation

By using these factors, surveyors can determine the fair sale price for a unit by working backwards from comparable sales and factoring in condition and rental income. This calculation is known as the capitalisation rate or cap rate (CR), and it’s a crucial tool for assessing whether an investment will deliver solid returns.

Capitalisation Rate = [Net Operating or Rental Income / Current Market Value of the Property] x 100%

So, for a property whose annual rental income is £30,000 and currently valued at £300,000, the cap rate is 10%.

CR = [£30,000 / £300,000] x 100% = 10%

How Yield Investing Can Help

At Yield Investing, we specialise in ethical buy-to-let social housing investment opportunities in prime UK locations such as Durham, Middlesbrough, Hartlepool and Yorkshire. By “ethical social housing/supported living,” we mean our properties are designed to support assisted living personnel and are fully supported by the local government contracts.

This also means as an investor, you have secured yearly rent income with other benefits such as damage or maintenance cover and free property management. Our tenants treat the housing associations as a landlord rather than reporting directly to you, which makes this an easy hands-free investment for your property portfolio.

We offer various investment options, including individual flats in blocks, fully freehold blocks, large HMOs/bedsits, and family rentals. These options are top-rated among overseas clients who seek to purchase prime UK real estate with tenants and a management company already in place, providing a steady yield with solid growth potential.

As a reputable developer, we consistently deliver high-quality properties that we are confident will interest our clients. Our track record speaks for itself. By investing with us, you can benefit from long-term leases, strong tenant covenants, and high net returns. Don’t miss out on this opportunity to invest confidently and earn a steady interest- you can contact us today by filling out this contact form.